Faced with the current delicate economic situation that we are still suffering due to the COVID19 pandemic, the Government of Asturias takes the initiative with a series of measures for a strong boost to the recovery of the Asturian business fabric.

Sociedad Regional de Promoción (SRP) allocates 14.5 million euros to three new lines of financing to support companies affected by COVID19, the setting up of innovative industries to the region, and the creation and growth of startups.

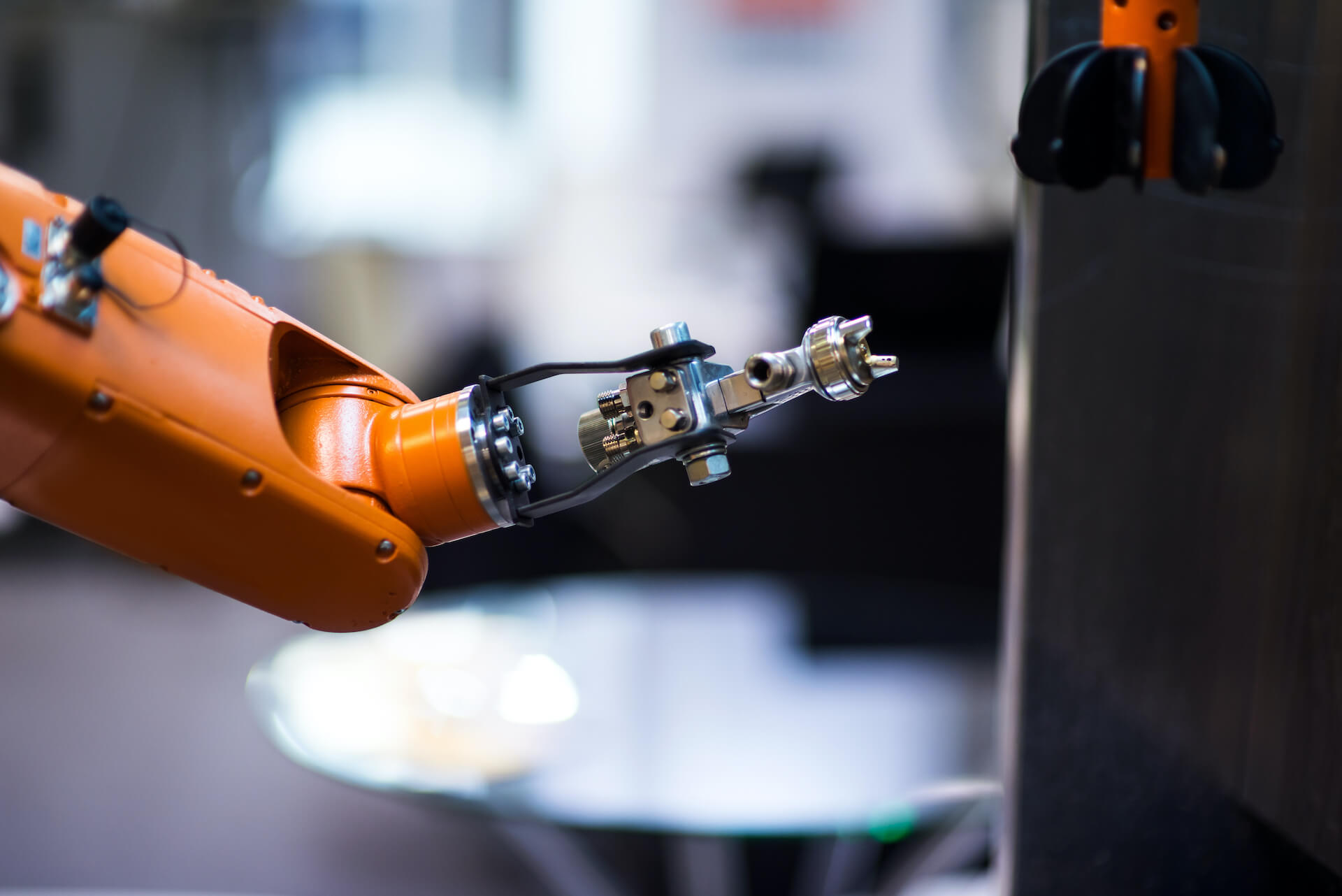

SRP wants to facilitate the setting up of new companies in Asturias through the “Support line for the setting up of emerging industries”, with a budget allocation of 4 million euros. It is aimed at companies that want to set up in our region with an innovative project that fits in with the Investment Attraction Strategy led by the Institute for Economic Development of the Principality of Asturias (IDEPA).

This fund for emerging industries is also aligned with the Regional Government´s strategies to support the digitisation of industry.

These are the main characteristics of this support line for the setting up of emerging industries in Asturias:

- Budget allocation: €4 million.

- Instrument: Convertible equity loans.

- Beneficiaries: Companies wishing to set up in Asturias with an innovative project in the expansion and growth phase that need financing to boost their project.

- Eligible investments:

- Acquisition of fixed assets.

- Current assets are necessary for the development of the activity.

- The specific characteristics of the project will be taken into account when assessing the investments in intangible fixed assets (R&D&I) eligible for financing.

- Company requirements:

- To have a commercial legal form.

- Relocation of the registered office and tax domicile to Asturias.

- Be in a phase of expansion and growth, with a minimum of 3 years experience. In the case of younger companies, the experience in the sector of the promoting team must be accredited.

- Co-financing of the investment (by the company itself, its promoters or third parties) with an amount of at least 25% of the total investment.

- It will be positively valued that the company develops its activity within the sectors considered as a priority for Asturias in the regional development policies.

- Project requirements:

- Recurrent invoicing on a monthly basis.

- Be viable from a technical, financial, commercial and business management point of view.

- Be innovative in nature, whether it involves innovation of products, services and/or processes (not necessarily technological).

- Its dynamising effect on the economy and its capacity to generate stable employment will be positively valued.

- Management team knowledgeable of the sector, capable and involved in the project, covering the main roles of the company.

- The overall financing of the project must be secured.

- Financing characteristics:

- Amount: maximum €600,000 (€1,000,000 in industrial projects).

- Term: 4 to 7 years.

- Grace period: period to be assessed depending on the expected evolution.

- Fixed interest: depending on the economic-financial and technical assessment of the project (between Euribor + 3% and Euribor + 5%).

- Variable interest: depending on the company’s results, with a maximum of 3 additional points on the fixed interest.

- Amortisations: monthly and gradual.

- Guarantees: no guarantees.

- No commissions of any kind.

- Audit: obligation to present the annual audit of the accounts.

- Convertible into capital: in a round of external financing, the company value for SRP will have a discount of 20%. In the case of capitalisation, the commitment of permanence and exclusivity of the promoter team for two years.

- Operational:

- Selection of the project through the Asturias Investment Attraction Strategy.

- Contact with SRP at any time of the year, explanation of the project and presentation of a 5-year business plan.

- Analysis of the project by the SRP technical team, which makes an investment proposal to the Board of Directors.

- SRP Board: the Board of Directors of the company approves the investment proposal, if applicable.

- Formalisation: if the transaction is approved, it is formalised before a notary.

- Six-monthly monitoring of compliance with the business plan.

- Processing times: maximum of 1 month from the time the technical team has all the information.

- Applicable legislation: Royal Decree-Law 7/1996 of 7 June 1996, partially amended by the Second Additional Provision of Law 10/1996 of 18 December 1996, in the case of participating loans.